There is no longer any forum to comment on development issues now that the RGJ has eliminated comments. Do you want REreno back or just don’t care?

Is ReRENO Relevant Again?

22 Wednesday Feb 2023

Posted in Uncategorized

22 Wednesday Feb 2023

Posted in Uncategorized

There is no longer any forum to comment on development issues now that the RGJ has eliminated comments. Do you want REreno back or just don’t care?

14 Wednesday Jul 2021

Posted in Uncategorized

Agenda Item 2 for the Reno Arts and Culture Commission is a “Land Recognition Statement”:

05 Monday Jul 2021

Posted in Uncategorized

So where have I been the last 6 months any why did I stop posting?

First of all, my little urban infill firm is working on over 160 units in the urban core right now. 320 Grand Canyon is submitted for permit, 542 7th Street in Sparks is similar to 320 GC and waiting to submit for the first round of Plan Check Comments, 597 Grand Canyon will be submitted for an MCUP (Minor Conditional Use Permit) for 26 units on Monday, 16 units on Haskell are in Design Development, and another 75 units downtown are in development. Plus another 15 or so SLPs (shitty little projects, sorry clients!).

More importantly for posting, I have lost faith in the Planning Review process and haven’t found posting about new projects worthwhile or productive A submission to Planning for a tentative map is now just a Pre-Appeal which will be appealed to the Hearing Officer and then Judicial Review, then rinse and repeat. 2-3 year process to maybe yes or maybe no on a project. Stan Lucas, Reno Gateway Business Park, Meridian 120S, Santerra, Boomtown frankenwarehouse 2. There is no reason for me to report on these if they are going to be tied up the the legal and planning process for years.

Gossip is always good, but I work many of the the people I write about. Has the Katerra BK affected more than just the Westview project? I think so ,but don’t feel the need to get in the middle of it. Where is Reno Land’s 450N project, aka Belvedere S tower? Why is the Compass Point apartment project downtown now slated to be a stocking site for the UNR garage project for a couple of years? Who are the decision makes at the City of Reno when virtually every power position is “acting”?

I’m still here.

Mike

08 Monday Feb 2021

Posted in Uncategorized

One R is the newest addition to the Midtown rental stock and the largest infill project yet at 70 Units. Floor plans and rental rates are HERE. All in all about 20% below the asking rents at REDreno aka Park Lane Mall with meager amenities but a walkable location. Where do you want to live?

One R is the newest addition to the Midtown rental stock and the largest infill project yet at 70 Units. Floor plans and rental rates are HERE. All in all about 20% below the asking rents at REDreno aka Park Lane Mall with meager amenities but a walkable location. Where do you want to live?

FYI, this is the current incentive offer at RED:

Our first move-ins are scheduled for January 2021! Our founding residents are eligible to receive four weeks on us and up to $2,000 gift card. Offer valid for a limited time on select apartment homes. Please speak to a leasing associate for details and restrictions.

08 Monday Feb 2021

Posted in Uncategorized

The Stan Lucas project located between West Meadows Estates and Somersett/Sierra Canyon will be back in front of the Reno City Council for reconsideration Wednesday night at 6 PM. the Zoom meeting can be streamed live from the City’s web site or viewed on Spectrum channel 194. The Council package is HERE under Item I.1.

The Stan Lucas project located between West Meadows Estates and Somersett/Sierra Canyon will be back in front of the Reno City Council for reconsideration Wednesday night at 6 PM. the Zoom meeting can be streamed live from the City’s web site or viewed on Spectrum channel 194. The Council package is HERE under Item I.1.

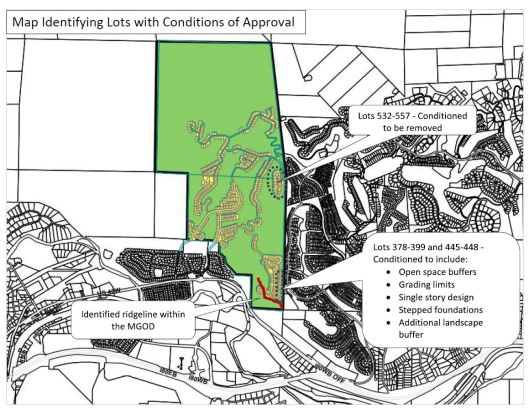

The original project was denied by the Planning Commission, appealed to the Council where it was also denied, then submitted for Judicial Review which found in favor of the developer citing “animosity towards the MGOD”. The findings of the Judicial Review were scathing of the Planning Commission and Council, and complimentary of Reno’s Planning staff. Council must now review the project strictly within the terms of the MGOD and must have very, very good reasons to not make the findings for the project.

The revised plan removes 30 or so lot, in general meeting Planning’s original proposed Conditions.

The revised plan removes 30 or so lot, in general meeting Planning’s original proposed Conditions.

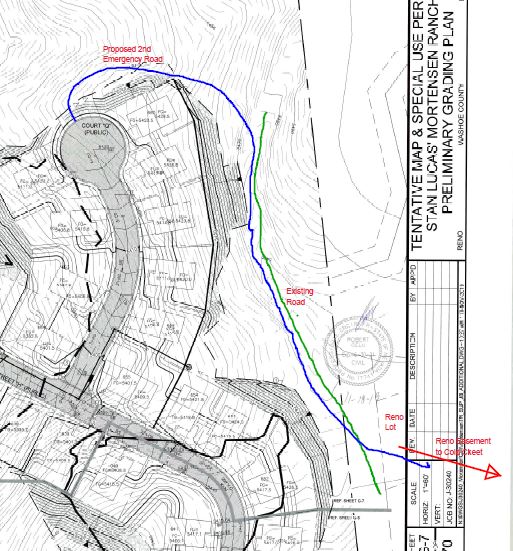

A second gated emergency access road is proposed to connect to Reno’s easement to Cold Creek in the Cliffs. There has been a lot of public comment about this reducing the existing “unmapped public road” that leads north to the properties farther up Peavine, but with gates at each end and sharing the road easement for a few hundred feet this should not be a problem.

A second gated emergency access road is proposed to connect to Reno’s easement to Cold Creek in the Cliffs. There has been a lot of public comment about this reducing the existing “unmapped public road” that leads north to the properties farther up Peavine, but with gates at each end and sharing the road easement for a few hundred feet this should not be a problem.

MGOD is a planning world to itself, created out a legal settlement and codified in 2004. It has it’s own set of rules and established densities and unit counts for the various Planning Areas. Stan Lucas is Planning Area 1. The 1250 unit Santerra project (also denied by the Planning Commission with the same flawed review standards) is Planning Area 3 and is being protested to Council. The Drakulich Judicial Review will be held up a precedent setting.

30 Saturday Jan 2021

Posted in Uncategorized

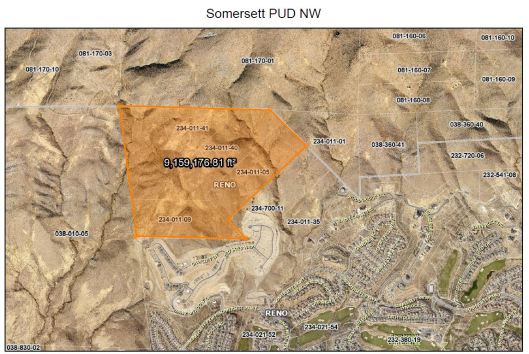

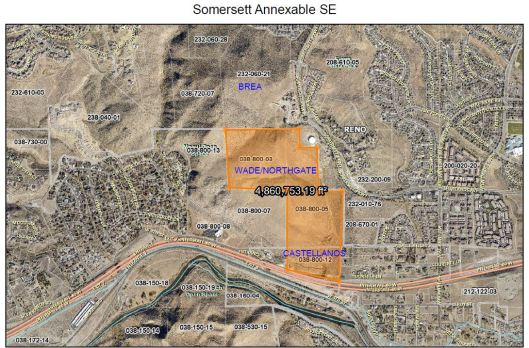

When a Master Developer (Declarant) establishes a PUD, they identify the land included in the PUD and also the “annexable land” they might want to bring into the PUD in the future on the same density terms as negotiated with the City. They can also annex up to 10% additional unit count with the same density on land not originally identified as “annexable”. Somersett at +/= 3500 units can annex in 350 additional units as well as transfer the 200 or so unutilized units under the current PUD.

When a Master Developer (Declarant) establishes a PUD, they identify the land included in the PUD and also the “annexable land” they might want to bring into the PUD in the future on the same density terms as negotiated with the City. They can also annex up to 10% additional unit count with the same density on land not originally identified as “annexable”. Somersett at +/= 3500 units can annex in 350 additional units as well as transfer the 200 or so unutilized units under the current PUD.

Somersett recently completed a detailed review of their governing documents to update them and remove the Declarant. The Declarant wants to retain some of his original entitlements. Where are the most likley additons to Somersett as we know it today?

NW – These parcels above Toll’s Village 6 Cliffs project are already incorporated into the Somersett PUD and are ripe for a TDR (Transfer of Development Rights) of the unulitized units.

NW – These parcels above Toll’s Village 6 Cliffs project are already incorporated into the Somersett PUD and are ripe for a TDR (Transfer of Development Rights) of the unulitized units.

SE – Wade/Northgate I believe was involved in the original assemblage of Somersett. These parcels were deemed to difficult too develop and did not become a part of the PUD, but were identified as “annexable properties”. Maybe 125 or so units?

SE – Wade/Northgate I believe was involved in the original assemblage of Somersett. These parcels were deemed to difficult too develop and did not become a part of the PUD, but were identified as “annexable properties”. Maybe 125 or so units?

A good HOA keeps your assessments low. A great HOA is forward looking and protects the community by understanding future threats to it.

28 Thursday Jan 2021

Posted in Uncategorized

A “new” project for the site of the demolished Lakeridge Tennis Club has been submitted for Planning review. Highlights include:

A “new” project for the site of the demolished Lakeridge Tennis Club has been submitted for Planning review. Highlights include:

– 314 condo units replacing the previously proposed 350+/- active senior apartments.

– 8 4-story buildings, 3 stories above a parking deck.

– Parking is provided per the 2 week old Development Code Update, 1 space per units up to 1250 SF and 2 spaces per units larger than 1250 SF. Old code was 1.5 spaces per 1 bedroom unit, 2 spaces per 2 or 3 bedroom unit, plus 1:10 guest parking.

The application documents are just starting to populate on Accela, but you can find the initial application HERE.

16 Saturday Jan 2021

Posted in Uncategorized

So what’s up at one of Reno’s largest PUDs?

So what’s up at one of Reno’s largest PUDs?

– Witt Storage is one approval away from a 496 unit mini-storage / RV storage facility on Somersett Ridge Parkway just East of their existing facility. 500 units would have triggered an SUP or CUP under the new Planning Code. What a great entry statement for you community.

Buy warning on Somersett right now.

14 Thursday Jan 2021

Posted in Uncategorized

12 Tuesday Jan 2021

Posted in Uncategorized

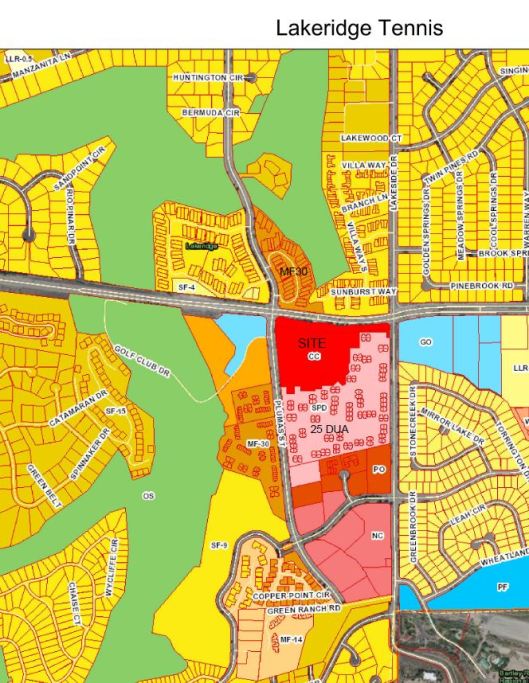

Councilperson Duerr has THIS proposal to reduce the zoning on the Lakeridge Tennis Club parcel from CC (as approved by the Council a year and a half ago) to MF14 – 14 units per acre, 2 storey maximum on the Council agenda for 13 January. This would reduce development potential on the site from the 350+/- units previously proposed to 119. What the owners purchased under the current approved zoning for $8.2M might be worth $3.5M under her proposal.

Councilperson Duerr has THIS proposal to reduce the zoning on the Lakeridge Tennis Club parcel from CC (as approved by the Council a year and a half ago) to MF14 – 14 units per acre, 2 storey maximum on the Council agenda for 13 January. This would reduce development potential on the site from the 350+/- units previously proposed to 119. What the owners purchased under the current approved zoning for $8.2M might be worth $3.5M under her proposal.

Can you remember ANY other case where a Councilperson has initiated a zoning change? And one that would certainly put the City of Reno at risk for legal action for “taking”?

The red zone is the site. Duerr’s proposal would be classic spot zoning. She might have gotten some traction at MF30, but to propose such low density on a site that the Master Plan states should be highly developed due to availability of infrastructure is just a knee-jerk reaction to her NIMBY constituents. Will the Council back her up?

The red zone is the site. Duerr’s proposal would be classic spot zoning. She might have gotten some traction at MF30, but to propose such low density on a site that the Master Plan states should be highly developed due to availability of infrastructure is just a knee-jerk reaction to her NIMBY constituents. Will the Council back her up?